A Guide to the Lasting Power of Attorney (LPA) in Singapore

Many people are familiar with a will, which is a legal document that sets out how their estate should be managed after death.

But what happens if you lose mental capacity and can no longer make decisions for yourself while still alive?

Without proper arrangements, your financial assets may be frozen, and institutions may not recognise decisions made by your loved ones on your behalf. This can cause significant hardship and delay. In such cases, your family will need to apply to the court to be appointed as your deputy, a process that is costly, time-consuming, and leaves you with no say in who is chosen.

Are there other alternatives for you and your loved ones?

This is where the Lasting Power of Attorney (LPA) comes in.

- What is the Lasting Power of Attorney (LPA)?

- Why should you create an LPA?

- Which LPA form should you use?

- Key considerations when making an LPA

- What should you do now?

What is the Lasting Power of Attorney (LPA)?

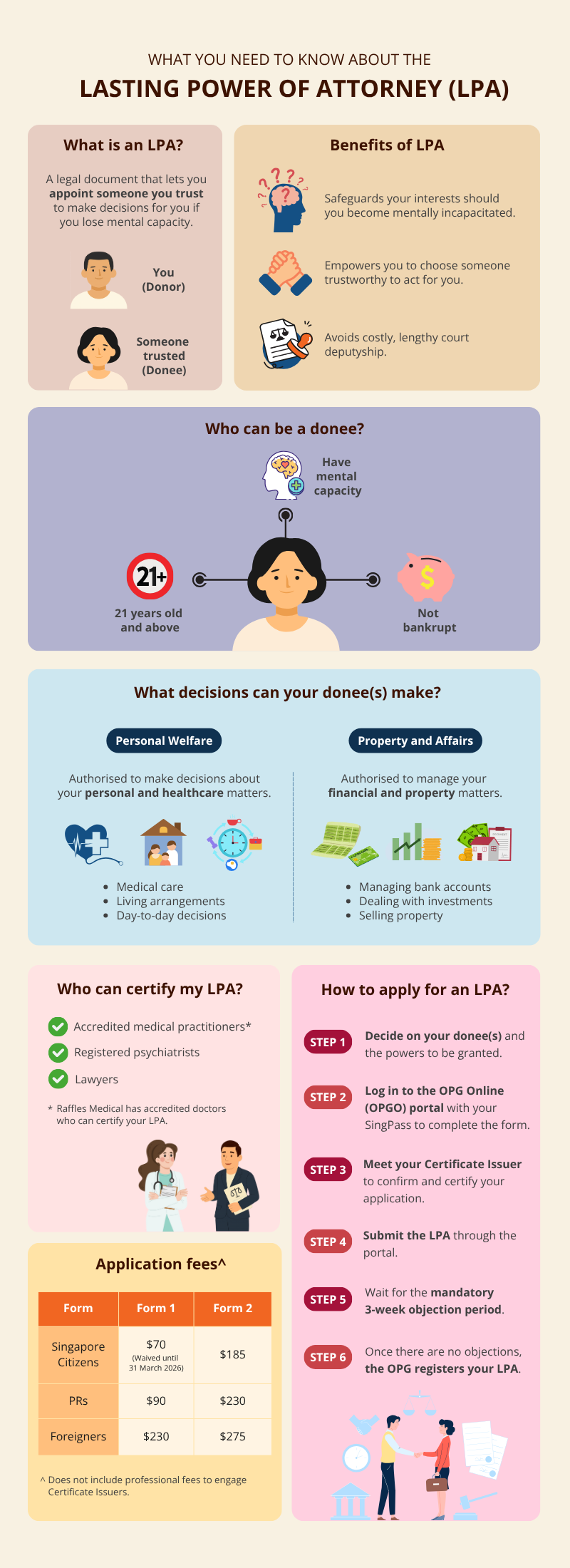

The LPA is a legal document that allows a person (the donor), aged 21 and above, to voluntarily appoint one or more people they trust (donee(s)) to make decisions and act on their behalf should they lose mental capacity.

The LPA is governed by Singapore’s Mental Capacity Act and registered with the Office of the Public Guardian (OPG).

Why should you create an LPA?

- Avoid deputyship

Your loved ones will not need to go through lengthy court proceedings. - Choose your representative

You decide who can act for you, instead of leaving it to the courts. - Peace of mind

Ensures continuity in managing your personal and financial affairs. - Reduce burden

Helps your family avoid stress, frustration, and additional costs.

Which LPA form should you use?

There are two types of forms:

- Form 1

Standard form covering general powers for personal welfare and property & affairs. Suitable for most people. - Form 2

Customised form for those with more complex needs. Must be drafted by a lawyer.

| Form Type | Form 1 | Form 2 |

| Purpose | Standard form with mostly pre-set options. | Customised form for specific or complex instructions. |

| Coverage | General powers over personal welfare and property & affairs. | Allows donor to grant customised powers, tailored to unique needs. |

| Suitable for | Majority of Singaporeans with straightforward needs. | Individuals with complex affairs, e.g. business owners, those with significant assets or special requirements. |

| Who prepares it | Donor completes the standard form. | Must be drafted by a lawyer. |

| Cost | Lower cost, as form is standardised. | Higher cost due to legal drafting. |

Key considerations when making an LPA

Number of donees

You can appoint up to two donees and one replacement donee.

How donees act

- Jointly

The donees have to act together and agree on all the decisions. - Jointly & Severally

The donees can make the decisions together or separately.

Scope of powers

Your donee(s) can be granted powers in:

- Personal welfare

This includes medical care, living arrangements, day-to-day decisions. - Property and affairs

This covers financial and property-related decisions, such as managing bank accounts, paying bills, dealing with investments, and selling property.

You may also limit powers or include specific instructions.

Replacement donee(s)

Replacement donees will step in if your original donee is unable or unwilling to act.

Who can be a Certificate Issuer?

A Certificate Issuer must certify that you understand the LPA and are not being forced into making it. They can be:

- An accredited medical practitioner

- Registered psychiatrist

- Lawyer

This safeguard helps ensure the LPA is valid and can withstand legal challenge.

If you are unsure of which Certificate Issuer to engage, here is a quick guide to help you decide:

| Certificate Issuer | When to engage | Form they can witness and certify |

| Accredited medical practitioners | Suitable for those who fully understand the risks and obligations of creating an LPA and have no legal questions. Raffles Medical has accredited doctors who can certify your LPA. Raffles Medical has accredited doctors who can certify your LPA. Note: The medical professional will not be able to provide legal advice. | Form 1 |

| Registered psychiatrists | Suitable for those with fluctuating mental capacity, possible or diagnosed mental health issues, or in the early stage of dementia.In the situation where someone challenges that you lacked the mental capacity to create an LPA, a psychiatrist can ascertain your mental capacity at the point when you signed it.

Note: The psychiatrist will not be able to provide legal advice. |

|

| Lawyers | Suitable for those who need legal advice about creating an LPA, or wish to grant customised powers to their donee(s). | Forms 1 and 2 |

The professional fees for engaging the Certificate Issuers will differ. Generally, the more complex your instructions and needs are, the higher the cost of engaging the Certificate Issuer.

How to apply for an LPA

- Decide on your donee(s) and the powers to be granted.

- Log in to the OPG Online (OPGO) portal with your SingPass to complete the form.

- Meet your Certificate Issuer* to confirm and certify your application.

- Submit the LPA through the portal.

- Wait for the mandatory 3-week objection period.

- Once there are no objections, the OPG registers your LPA.

*Appointed donee (LPAs) to complete their part of the approval process before seeing the certificate issuer.

What should you do now?

It is never too early to plan ahead. By making an LPA, you take charge of your future and protect your loved ones from unnecessary difficulty.

Book an appointment with a certified LPA issuer at a Raffles Medical clinic to get your Lasting Power of Attorney (LPA) certified today.

This article is reviewed by Dr Precelia Lam, General Practitioner, Raffles Medical

Disclaimer: This article is for general information only and does not constitute legal advice. Please consult a professional for advice tailored to your circumstances.